[ad_1]

The large shareholder teams in Blockchain Coinvestors Acquisition Corp. I (NASDAQ:BCSA) have energy over the corporate. Massive corporations normally have establishments as shareholders, and we normally see insiders proudly owning shares in smaller corporations. Firms that was once publicly owned are likely to have decrease insider possession.

Blockchain Coinvestors Acquisition I is a smaller firm with a market capitalization of US$410m, so it could nonetheless be flying underneath the radar of many institutional traders. Our evaluation of the possession of the corporate, beneath, exhibits that institutional traders have purchased into the corporate. We are able to zoom in on the completely different possession teams, to be taught extra about Blockchain Coinvestors Acquisition I.

View our latest analysis for Blockchain Coinvestors Acquisition I

What Does The Institutional Possession Inform Us About Blockchain Coinvestors Acquisition I?

Institutional traders generally evaluate their very own returns to the returns of a generally adopted index. So they often do contemplate shopping for bigger corporations which might be included within the related benchmark index.

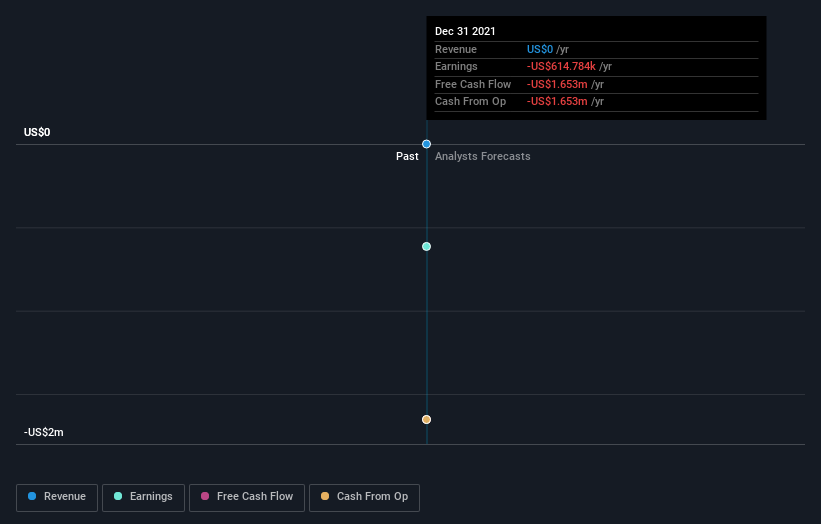

We are able to see that Blockchain Coinvestors Acquisition I does have institutional traders; and so they maintain portion of the corporate’s inventory. This will point out that the corporate has a sure diploma of credibility within the funding neighborhood. Nonetheless, it’s best to be cautious of counting on the supposed validation that comes with institutional traders. They too, get it fallacious typically. It’s not unusual to see a giant share value drop if two giant institutional traders attempt to promote out of a inventory on the identical time. So it’s value checking the previous earnings trajectory of Blockchain Coinvestors Acquisition I, (beneath). After all, needless to say there are different elements to think about, too.

It seems to be like hedge funds personal 6.2% of Blockchain Coinvestors Acquisition I shares. That is attention-grabbing, as a result of hedge funds could be fairly energetic and activist. Many search for medium time period catalysts that may drive the share value increased. Our information exhibits that Blockchain Coinvestors Acquisition Sponsors Llc is the biggest shareholder with 27% of shares excellent. Saba Capital Administration, L.P. is the second largest shareholder proudly owning 6.2% of frequent inventory, and HGC Funding Administration Inc. holds about 2.2% of the corporate inventory.

Story continues

Our research recommend that the highest 15 shareholders collectively management lower than half of the corporate’s shares, that means that the corporate’s shares are broadly disseminated and there’s no dominant shareholder.

Whereas finding out institutional possession for a corporation can add worth to your analysis, additionally it is observe to analysis analyst suggestions to get a deeper perceive of a inventory’s anticipated efficiency. So far as we will inform there is not analyst protection of the corporate, so it’s in all probability flying underneath the radar.

Insider Possession Of Blockchain Coinvestors Acquisition I

Whereas the exact definition of an insider could be subjective, nearly everybody considers board members to be insiders. Administration in the end solutions to the board. Nonetheless, it’s not unusual for managers to be govt board members, particularly if they’re a founder or the CEO.

I usually contemplate insider possession to be factor. Nonetheless, on some events it makes it harder for different shareholders to carry the board accountable for choices.

Our information means that insiders personal underneath 1% of Blockchain Coinvestors Acquisition Corp. I in their very own names. However they might have an oblique curiosity by a company construction that we’ve not picked up on. It appears the board members have not more than US$3.0m value of shares within the US$410m firm. Many are likely to choose to see a board with larger shareholdings. An excellent subsequent step may be to take a look at this free summary of insider buying and selling.

Basic Public Possession

Most of the people, largely comprising of particular person traders, collectively holds 58% of Blockchain Coinvestors Acquisition I shares. This dimension of possession provides traders from most of the people some collective energy. They will and doubtless do affect choices on govt compensation, dividend insurance policies and proposed enterprise acquisitions.

Personal Firm Possession

We are able to see that Personal Firms personal 27%, of the shares on situation. It is arduous to attract any conclusions from this truth alone, so its value wanting into who owns these non-public corporations. Generally insiders or different associated events have an curiosity in shares in a public firm by a separate non-public firm.

Subsequent Steps:

It is at all times value excited about the completely different teams who personal shares in an organization. However to grasp Blockchain Coinvestors Acquisition I higher, we have to contemplate many different elements. For instance, we have found 4 warning signs for Blockchain Coinvestors Acquisition I (2 do not sit too effectively with us!) that you need to be conscious of earlier than investing right here.

After all this is probably not one of the best inventory to purchase. Subsequently, you could want to see our free collection of interesting prospects boasting favorable financials.

NB: Figures on this article are calculated utilizing information from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This is probably not per full yr annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We purpose to convey you long-term centered evaluation pushed by elementary information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment