[ad_1]

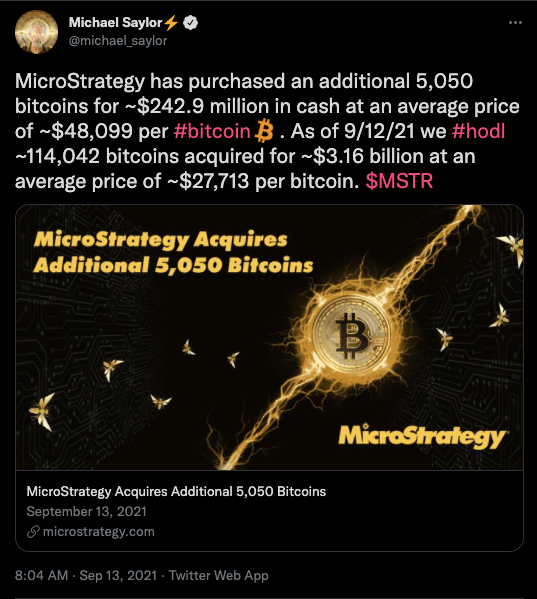

On Monday MicroStrategy CEO Michael Saylor introduced that the agency bought an extra 5,050 bitcoin for about $242.9 million in money through the third quarter interval.

The agency bought the cash at a median value of $48,099 per bitcoin. Saylor tweeted, “As of 9/12/21 we #hodl ~114,042 bitcoins acquired for ~$3.16 billion at a median value of ~$27,713 per bitcoin.”

The acquisition fulfills Michael Saylor’s pledge, through the agency’s Q2 earnings name, to buy extra bitcoin, and comes simply weeks after MicroStrategy bought an extra 3,907 bitcoin for about $177 million in money.

In the course of the third quarter of 2021 MicroStrategy bought a complete of 8,957 bitcoin for about $419.9 million. The typical value per Bitcoin was $46,875.

So far, the corporate holds roughly 114,042 bitcoin, acquired at an combination buy value of $3.16 billion and a median value per bitcoin of $27,713 per bitcoin, inclusive of charges and bills. The agency owns extra Bitcoin than another public firm on this planet.

The acquisition comes after MicroStrategy bought off its class A standard inventory in Jeffries, an ATM facility. In the course of the third quarter, MicroStrategy bought an combination of 555,179 shares of the ATM facility at a median gross value per share of $727.64 for about $399.9 million.

MicroStrategy has positioned itself as a frontrunner within the Bitcoin area by advocating for and serving to different corporations, corresponding to Tesla, to transform their stability sheets from {dollars} to Bitcoin.

Notably, MicroStrategy doesn’t partake in any Bitcoin lending or put money into another cryptocurrency. The agency’s constant technique has been to purchase Bitcoin with money, to self-custody it and to hodl it indefinitely.

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment