[ad_1]

Bitcoin (BTC) recently topped the $52K level, but this was short-lived because the top cryptocurrency experienced a significant pullback that prompted a $10K loss as over-leverage factors came into play.

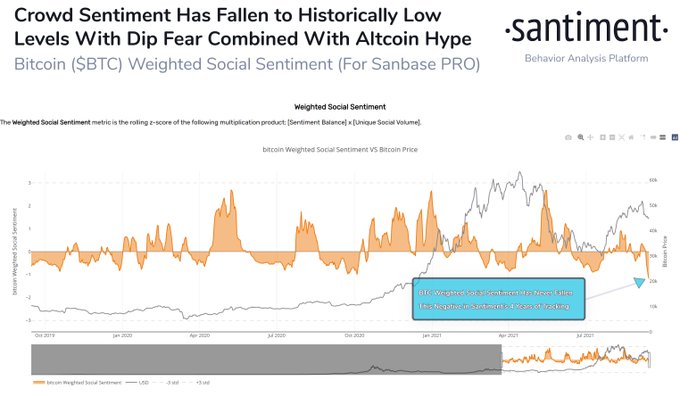

Santiment acknowledged this, together with fear, doubt, and uncertainty (FUD), which have made crowd sentiment towards BTC sink to historic lows. The on-chain metrics provider explained:

“Crowd FUD has hit historic levels toward Bitcoin, according to our algorithm measuring commentary volume, combined with positive vs. negative BTC scores. Severe negativity has historically led to inevitable price bounces after weak hands drop out.”

Nevertheless, Santiment noted that the high negativity witnessed in the Bitcoin market could prompt a price surge based on eliminating weak hands. These are investors who indulge in an asset for speculative other than future purposes.

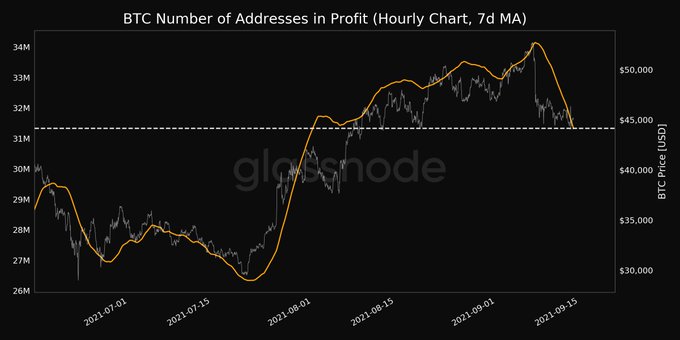

BTC addresses’ profitability sinks

According to crypto analytic firm Glassnode, the number of Bitcoin addresses in profit reached a 1-month low of 31,328,534.161.

On the other hand, Bitcoin futures perpetual funding rate recently turned negative, which indicated a tendency to short BTC as over-leveraged longs were wiped out.

Bitcoin whale holdings go through the roof

According to on-chain analyst Will Clemente:

“Whales holdings have increased by 103,600 BTC in the last 3 weeks.”

BTC whales have been on an accumulation spree despite the recent market crash. Market analyst Ali Martinez added that whales have been buying because addresses with 10,000 to 100,000 BTC purchased 50,000 BTC in just four days.

Is Bitcoin emerging to be a macro asset?

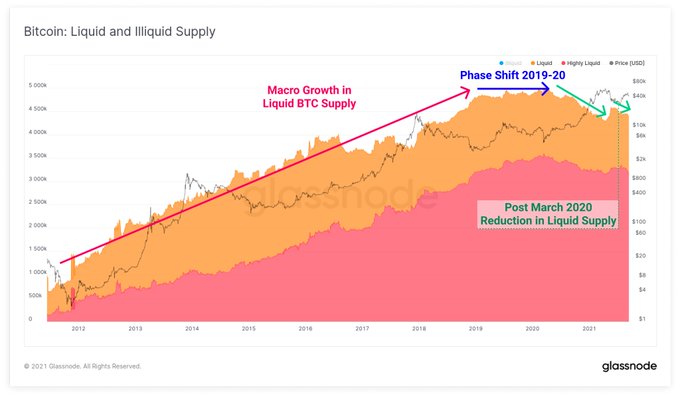

Glassnode noted:

“The amount of Liquid Bitcoin on-chain has been in structural decline since the March 2020 market crash. This underlines a phase shift in investor appreciation of Bitcoin as a macro asset, with a long time horizon.”

Meanwhile, open interest in the BTC market seems to be highly correlated with price. For instance, Bitcoin’s perpetual swaps open interest topped the $16 billion mark last week, and at the time, the price was hovering around the $50K mark.

BTC’s price was $45,780 during intraday trading, according to CoinMarketCap.

Image source: Shutterstock

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano

Be the first to comment