[ad_1]

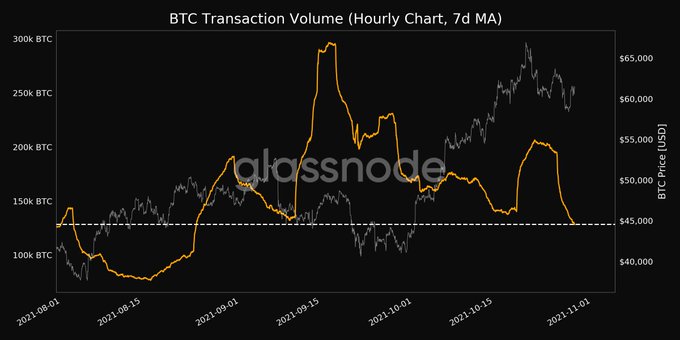

Bitcoin’s momentum has dried up a bit since it retraced from the all-time high (ATH) price of $66,900 set on October 20. As a result, the leading cryptocurrency has found itself in a consolidation state based on low transaction volume.

Market insight provider Glassnode explained:

“Bitcoin transaction volume (7d MA) just reached a 1-month low of 128,266.846 BTC.”

Reportedly, this correction has been sparked by long-term holders taking profits.

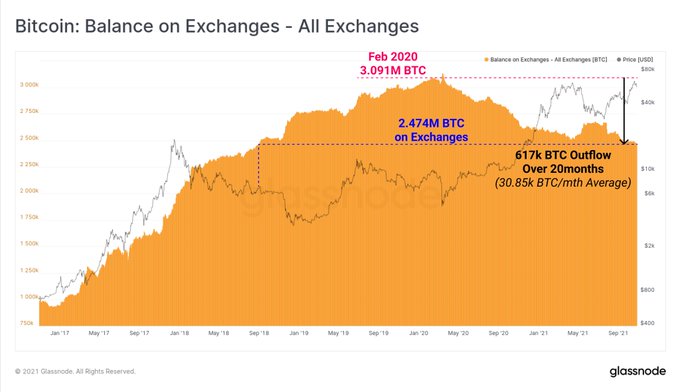

On the other hand, a bullish signal is popping out, given that Bitcoin balances on exchanges have sunk to a three-year low. Glassnode added:

“Bitcoin balance held on exchanges has continued to decline this week. Balances have fallen to 2.474M $BTC, returning to levels last seen in Aug 2018. Since Feb 2020, the average rate of outflow has been 30.85K $BTC per month.”

It is a bullish signal because it illustrates a holding culture, given that coins usually leave crypto exchanges for cold storage and digital wallets.

Is the Bitcoin market less leveraged?

Economist Alex Kruger believes that the Bitcoin market is less leveraged than analysts think because the CME prompted the surge in open interest (OI) witnessed in the last month. He explained:

“Most of the bitcoin OI increase of the last month was driven by the CME. The CME requires 40%-50% in margin, so max leverage is about 2x. In contrast, leverage in crypto exchanges is *much higher.* Bottom line: the market is considerably less levered than analysts think.”

Meanwhile, on-chain analyst Will Clemente suggests that the shakeouts in the BTC market should not dampen the crypto community’s spirits because Bitcoin whales have been on a spending spree in the past two weeks.

It remains to be seen how Bitcoin shapes up in the short term.

Image source: Shutterstock

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON

Be the first to comment