[ad_1]

Bitcoin, the oldest cryptocurrency, on Monday blew past $67,000 for the first time, hitting $67,523.28 in recent trading.

The markets have been in a bull mode since the beginning of the October, as the crypto market in total has added nearly $1 trillion to its total value in just a month. At the press time, the total market capitalization of cryptocurrencies has reached near $3 trillion, according to data from CoinMarketCap.

As CoinDesk reported, bitcoin is widely perceived by many investors as a store of value asset like gold, making the crypto a haven as worries about inflation increase. Meanwhile, blockchain data from Glassnode shows that the number of unique wallets with a balance of more than zero bitcoin has returned to near 39 million, a number that’s close to a record high of 38.7 million in May.

At the same time, Glassnode noted in its weekly report on Monday that bitcoin’s balances on exchanges continued to drop, while Bitcoin mining hashrate, a measure of the total computational power being used to secure the Bitcoin blockchain, could return new all-time highs before the end of the year – after it plunged in July due to China’s crackdown in bitcoin mining.

At the same time bitcoin was surging above $67,000 around 11:14 p.m. UTC Monday, ether, the second largest cryptocurrency by market capitalization, also set an all-time high, hitting $4,794.99, according to CoinDesk.

Ether’s surge came as reports show that the Ethereum network burned more ether than it issued for at least a week, after Ethereum’s London hard fork upgrade introduced a mechanism to burn a large portion of transaction fees, measured in ether, instead of sending them to miners. Burning means that the ether is permanently removed from the circulating supply.

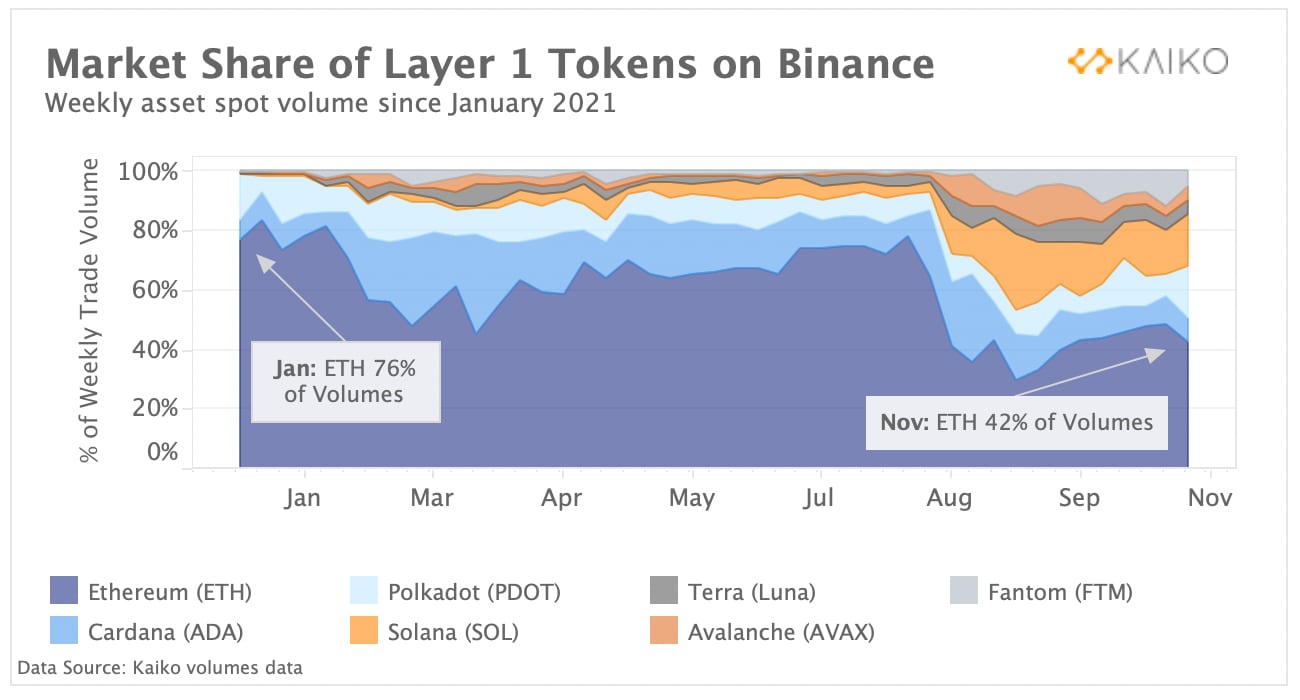

Meanwhile, the concerns around Ethereum blockchain’s scalability and high transaction fees continued to move parts of the market’s attention to so-called Ethereum alternative tokens including solana (SOL), polkadot (DOT), terra (LUNA), and avalanche (AVAX).

Data from blockchain data firm Kaiko shows that ethereum is losing market share to other popular layer 1 blockchains since the beginning of the year, as ether’s trading volume on Binance, the largest crypto exchange in the world, has fallen to 42% from 76% in the beginning of the year with the lost volume shifting to other layer 1 tokens.

“The recent [non-fungible token] fervor has again generated high transaction fees on the Ethereum blockchain, making alternate networks that solve for scalability concerns more attractive,” Kaiko wrote in its newsletter on Nov. 8.

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether

Be the first to comment