[ad_1]

Bitcoin whales who sold at the top in mid-April are yet to start accumulating BTC

New address growth on the Bitcoin network has dropped to levels last seen in early 2018

All these metrics negate what some traders and analysts have been posting about Bitcoin having bullish on-chain metrics

Bitcoin analyst and Founder of Capriole Investments, Charles Edwards, has identified several concerning metrics with respect to BTC’s daily active addresses and the growth of new addresses on the network.

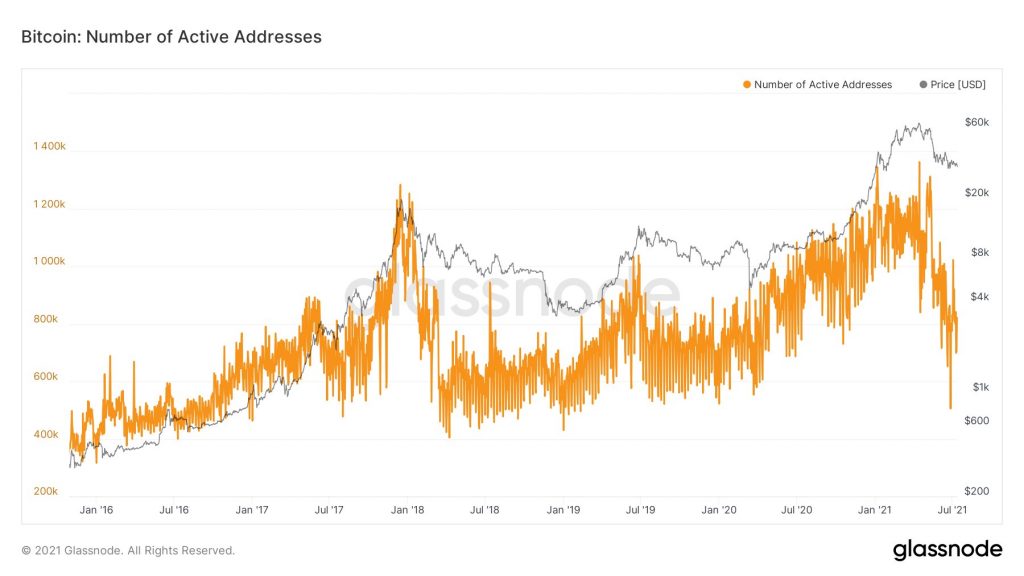

Bitcoin’s Daily Active addresses Have Halved

To begin with, and according to his analysis, Bitcoin’s daily active addresses have halved since BTC set an all-time high value of $64,854 in mid-April. Mr. Edwards went on to share the following chart to demonstrate this fact.

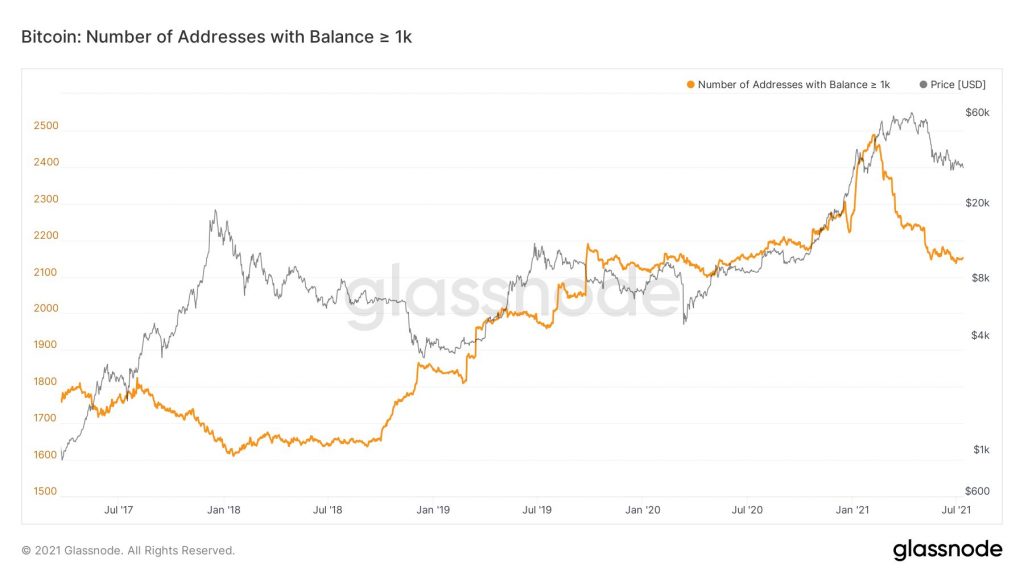

Bitcoin Whales Who Sold at the Top, Are Yet to Start Accumulating

Bitcoin Whales Who Sold at the Top, Are Yet to Start Accumulating

Secondly, Mr. Edwards pointed out that the Bitcoin whales who sold their bags as BTC pushed towards $64.8k, are yet to start buying. He went on to share the following chart highlighting the drop in the number of Bitcoin whales, holding more than 1k since BTC set its most recent all-time high.

Bitcoin’s New Address Growth Has Dropped to Levels Last Seen in Early 2018

Thirdly, Mr. Edwards pointed out that new address growth on the Bitcoin network has dropped to levels last seen in early 2018 during the market crash of that cycle. He further provided the following chart to demonstrate this fact.

Bitcoin’s Address Metrics Look ‘Awful’, ‘Terrible’

It is with the above data and charts that Mr. Edwards went on to conclude that Bitcoin’s on-chain metrics with respect to addresses, paint a bearish picture as opposed to what many traders and analysts have been sharing on social media. An excerpt of his analysis of the situation can be found below.

I keep seeing posts on bullish Bitcoin address growth, but every address metric for Bitcoin looks awful…

These metrics can change quickly.

But for now, Bitcoin addresses metrics look terrible.

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment