[ad_1]

(Edited by James Rubin)

Good morning. Here’s what’s happening:

Market moves: Bitcoin broke $52,000 briefly, while its supply outside of exchanges reached record highs.

Technician’s take (Editor’s note): Technician’s Take is taking a holiday hiatus. In its place, First Mover Asia is publishing a column by CoinDesk Chief Content Officer Michael Casey.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $50,866 +.09%

Ether (ETH): $4,043 -0.8%

Markets

S&P 500: $4,791 +1.38%

DJIA: $36,302 +0.9%

Nasdaq: $15,871 +1.39%

Gold: $1,811 +0.2%

Market moves

Bitcoin, the oldest cryptocurrency, remained at the $51,000 level after it briefly broke above $52,000 during U.S. trading hours on Monday. At the time of publication, bitcoin was hovering just below $51,000. Ether was down slightly just above the $4,000 mark.

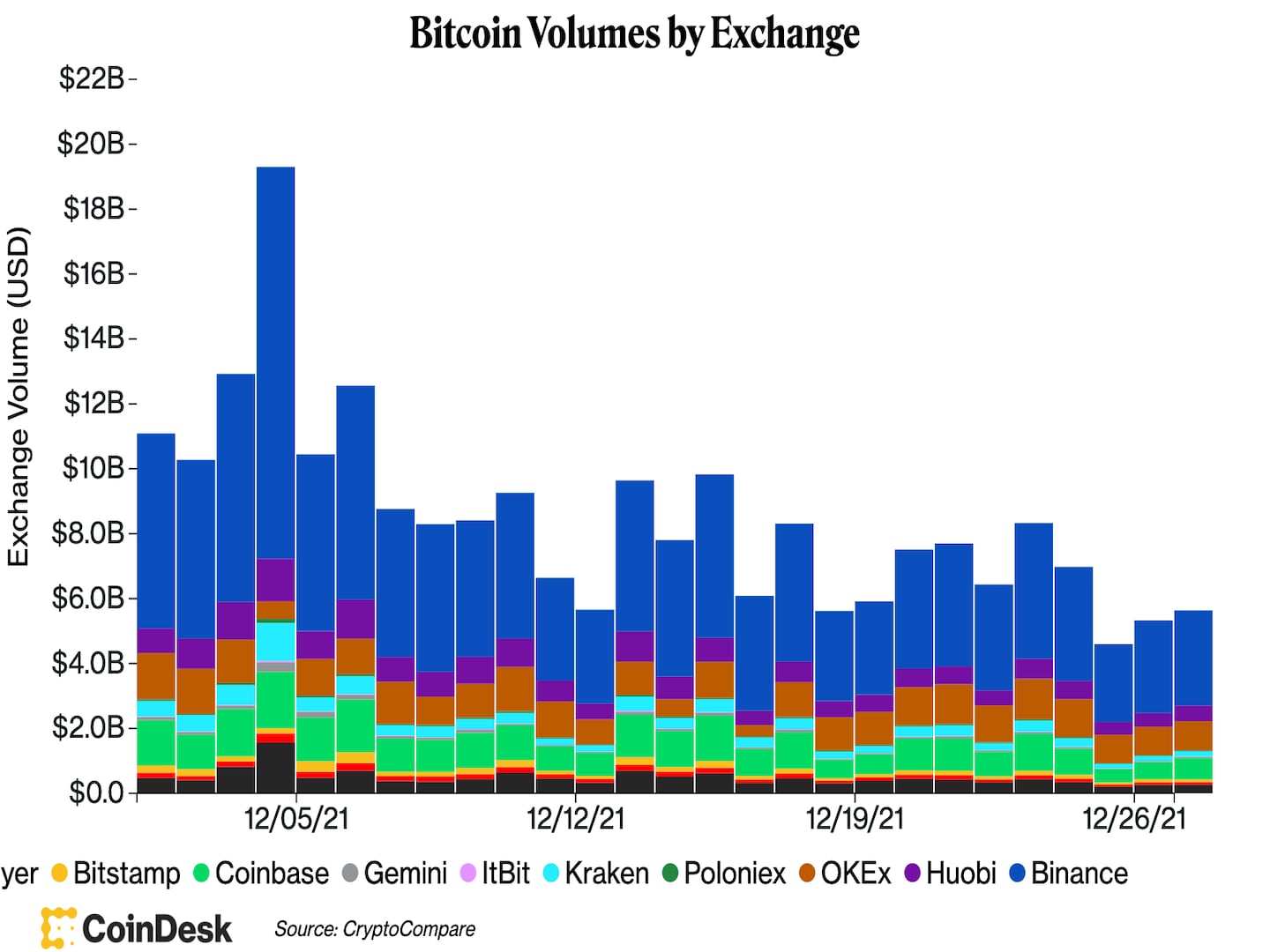

But trading activities were mostly muted, as the trading volume of the No. 1 cryptocurrency by market capitalization across major centralized exchanges was only slightly higher than it was on Sunday. Bitcoin’s low-volume rally came as stocks in the U.S. also rose in a week that’s traditionally marked by light but bullish trading.

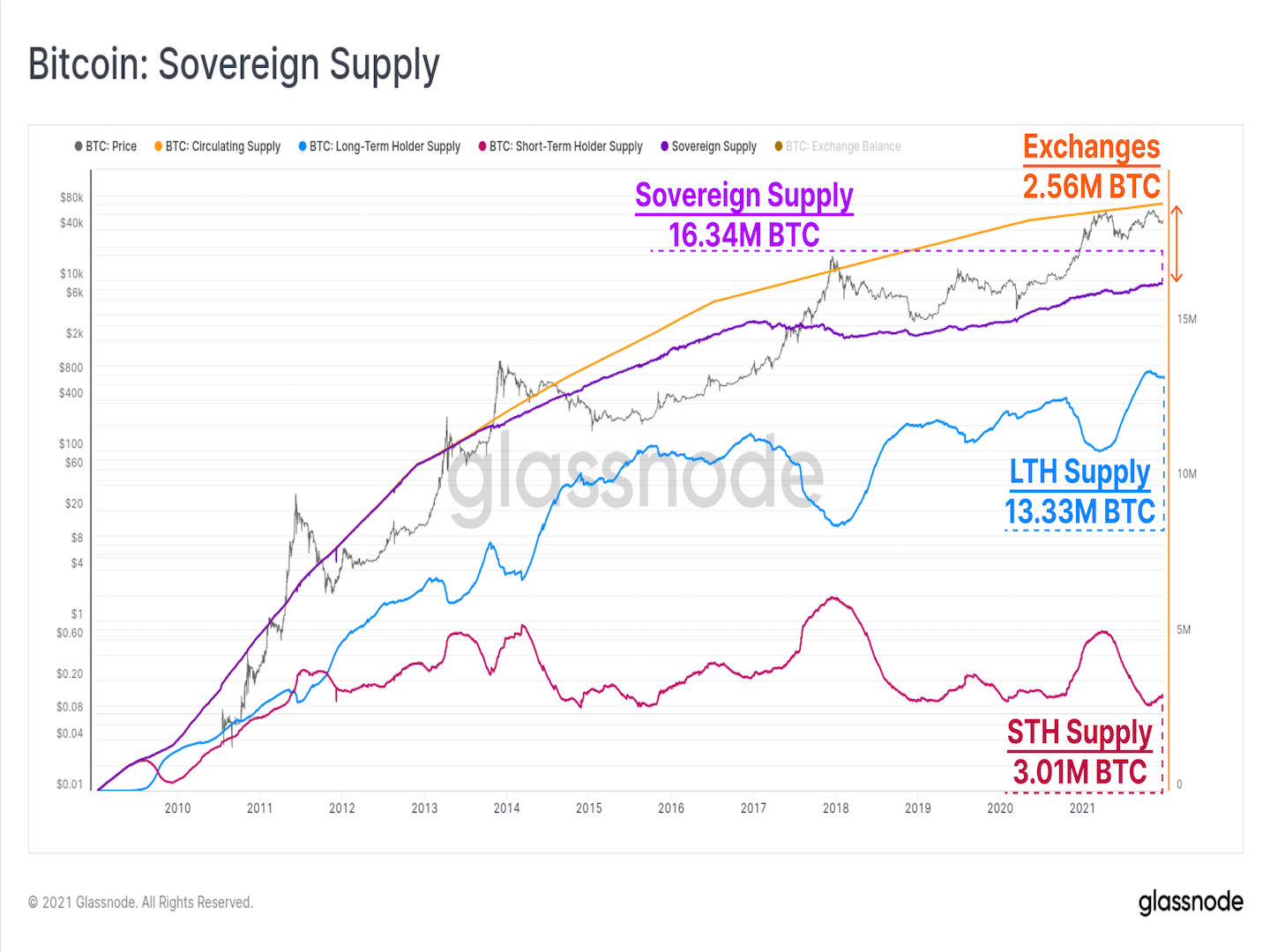

Meanwhile, as the market enters the end of the year, the so-called sovereign supply of bitcoin – total coins held outside of exchange reserves – reached an all-time high, according to blockchain data firm Glassnode.

The growth of bitcoin’s sovereign supply came as its long-term holders saw their ownership stake increase by 4.8% to reach 74.8% of all sovereign supply over the past year, Glassnode noted in its Dec. 27 newsletter. Short-term holders’ bitcoin ownership dropped from 28% this past January to 25.2% now.

“Such on-chain behavior is more typically observed during bitcoin bear markets, which in hindsight are effectively lengthy periods of coin redistribution from weaker hands, to those with stronger, and longer-term conviction,” Glassnode wrote.

Column

5 Ways Money Was Reimagined in 2021: Michael Casey looks back at a tumultuous year for money. (By CoinDesk Chief Content Officer Michael Casey)

It was the year of crypto!

For this, the first of two holiday editions of this Money Reimagined column, we frame this remarkable year in terms of how, in different ways, money was reimagined in 2021. We look at five themes, with links to past newsletters and podcasts.

You’re reading Money Reimagined, a weekly look at the technological, economic and social events and trends that are redefining our relationship with money and transforming the global financial system. Subscribe to get the full newsletter here.

In 2021, money became…

A meme

Whether it was the mania for dogecoin, the surge of interest in non-fungible tokens or the capacity for Wall Street Bets to set the price of “meme stocks” like GameStop, we witnessed a strange merging of finance and popular culture. As incredulous as people were in both traditional financial and Bitcoin circles, we at Money Reimagined felt somewhat vindicated. The trend underscored a theme we’ve explored in both the newsletter and the podcast: that monetary systems require a shared belief in their common value. This era of reimagined money is bound to see the deployment of art, iconography, stories and other cultural products to bolster the sense of belonging and belief among communities that form around these new systems.

A politicized idea

For the past century, no one really questioned the nature and structure of our systems of money. Money was issued by governments and it was run by banks. End of story. With the emergence of Bitcoin, there was suddenly a new way to think about things. But for most of its existence, the political class felt it could simply ignore it.

In 2021, that blissful ignorance suddenly became impossible. We first saw this with the debate over the infrastructure bill, most importantly in the U.S. Senate, when the impositions of a contentious tax reporting provision for cryptocurrency sales had the ironic effect of demonstrating that crypto had arrived in Washington. The fact that legislators wanted to tax crypto was a sign that it was recognized as a long-term prospect, a reliable source of tax revenue. Just as importantly, the crypto lobby, though ultimately unsuccessful in its bid to force changes to those more draconian parts of the provision, showed its clout on Capitol Hill has grown significantly. It forged a large, bipartisan coalition of lawmakers to support its preferred amendments and showed it will be a force.

Around the same time, the conversation around stablecoins as alternatives to central bank digital currencies started taking on greater appreciation in Washington. Randal Quarles, who was vice chairman of the Federal Reserve until he resigned from the post in November, even argued that stablecoins could bolster U.S. power overseas by tapping into private sector innovation that central banks inherently won’t have access to. That set the stage for an intense debate on stablecoins through the summer and fall, particularly around whether issuers of stable tokens such as USDC and PAX should be required to get banking licenses.

Finally, in December, a crypto hearing in the House of Representatives revealed something that none of us would have predicted a year ago: some very well-informed questions from lawmakers. It seems that many in Congress have finally done their crypto homework. We had Nik De, CoinDesk’s managing editor for global policy and regulation, on the podcast to discuss it.

A matter of geopolitical importance

Even if it took federal politicians some time to wake up to the political ramifications of cryptocurrencies and of the central bank-led alternatives they helped spawn, China’s rapid development of the latter had caught the attention of academics and think tanks. They recognized that Beijing’s deployment of its Digital Currency Electronic Payments (DCEP) system, which went in for heavy testing in 2021, has the potential to disrupt U.S. dominance of the global financial system.

What few saw coming was that China would also forfeit a dominance of bitcoin mining that it had for many years by launching a crackdown against such operations around the country. That led to a massive drop in the Bitcoin network’s capacity, as about half of the global hashrate, or computing power, shut down. But that hash power soon moved elsewhere, and especially to the U.S. By October, the U.S. had become the biggest mining location in the world. Already people are talking about what this increased role for the U.S. in a decentralized currency means for the U.S. as China pushes its centralized monetary solution on the world.

A speculative force for social innovation

In 2020, the speculative fervor around decentralized finance fueled such a powerful flywheel of investment capital and innovation that it helped frame our look back on the 12 months that preceded the one-year anniversary of the “Money Reimagined” podcast this past October. In 2021, the phenomenon was taken to a new level as speculation around non-fungible tokens fueled a flurry of ideas around the future of media, art and collectibles, which in turn kept attracting more and more money into the space. It all felt very much like a bubble, but it was also clear that speculation in this case was a feature, not a bug, a powerful driver of change – even if we don’t yet know where that change is ultimately taking us.

A dinner party conversation

Perhaps the biggest theme of 2021 was simply how mainstream crypto had become in terms of public awareness. With the NFT zeitgeist, soaring token prices, the fact that Washington was more interested to learn about it and the ideas that swirled around bitcoin being a bet against a failing monetary system, crypto was suddenly everywhere. Everyone wanted to understand it. Meanwhile, plenty of people who did understand it, as well as many who didn’t, formed strong views on crypto’s pros and cons. So, be warned as you sit down for a holiday dinner with family, you may be asked to explain yourself.

Happy holidays!

Important events

8 a.m. HKT/SGT (12 a.m. UTC): Spain retail sales (Nov. YoY)

1:55 HKT/SGT (5:55 a.m. UTC): U.S. Redbook index (Oct. YoY)

2 p.m. HKT/SGT (6 a.m. UTC) U.S. Housing price index (Oct. MoM)

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

Grayscale’s 2022 Outlook, A Shift in Bitcoin Demographics, End-of-Year Taxes

“First Mover” dove into crypto markets and end-of-year taxes. Joining the show to discuss are Rayhaneh Sharif-Askary, head of investor relations at Grayscale, and Mark Steber, chief tax information officer at tax firm Jackson Hewitt. Plus, “First Mover” looked at shifting bitcoin demographics and their implications for crypto markets in 2022. Grayscale is owned by Digital Currency Group, which is also CoinDesk’s parent company.

Latest headlines

Indian Ruling Party-Aligned Group Takes Stance on Crypto Regulation: The group is unlikely to have much influence on government policy, analysts said.

Cardano Founder Charles Hoskinson Lays Out 2022 Plans: Hoskinson said the creation of a formal open-source project structure for Cardano is on the cards, among other developments.

Binance Gains Bahrain Approval to Become Crypto Asset Service Provider, Registers in Canada: Bahrain’s “in principle” approval still requires the crypto exchange to complete the application process for a license from the central bank.

Decentraland, Luxury Marketplace UNXD to Host Metaverse Fashion Week: Decentraland and UNXD are calling on fashionistas to have their virtual collections ready to show in the metaverse.

Longer reads

10 2022 Predictions From PwC’s Henri Arslanian: El Salvador. The metaverse. Web 3 catalysts. Ethereum’s future.

Today’s crypto explainer: What Is a Decentralized Application?

Other voices: Who Goes Crypto? (Mother Jones)

Said and heard

“Decentralized application (dapp) ecosystems in alternative smart contract blockchains, such as Solana and Binance Smart Chain, will continue to grow as bridges increase cross-chain access to liquidity and developer platforms make it easier to launch dapps on other chains.” (Pantera Capital Partner Paul Veradittakit for CoinDesk) …”Many large private banks disregarded bitcoin as not a serious asset (not having crypto-related products to sell probably did not help!). But we should expect most to do a 180 and introduce crypto offerings in 2022.”(PwC Crypto Leader Henri Arslanian for CoinDesk) … ”When you make vaccination a requirement, that’s another incentive to get more people vaccinated. If you want to do that with domestic flights, I think that’s something that seriously should be considered. (Dr. Anthony Fauci as quoted by the New York Times) … ”THE SPEED of the economic bounce-back from the enormous recession of 2020 has taken many forecasters by surprise. Output across the 38 mostly rich OECD countries combined probably surpassed its pre-crisis level a few months ago. The average unemployment rate across the club, at 5.7%, is in line with the post-war average.” (The Economist)…”So much of AI is about compressing reality to a small vector space, like a video game in reverse.” (Tesla founder Elon Musk)

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment